Forex trading times are crucial for the success of traders in the global market. By understanding the nuances of these times, you can significantly enhance your trading strategy and profit potential. Many traders overlook the importance of timing, but it can make all the difference between a successful trade and a loss. This article will delve into the best trading times, market sessions, and tips on how to maximize your returns in forex trading.forex trading times Pakistan Brokers

Forex trading times refer to the specific hours during which trading takes place in the foreign exchange market. The forex market operates 24 hours a day, five days a week, but not all hours are equally advantageous for trading. Different trading sessions open at various times, influenced by the business hours of financial centers around the world.

The forex market is divided into four major trading sessions: Sydney, Tokyo, London, and New York. Each session has its unique characteristics and trading volume, which can impact the currency pairs traded.

The Sydney session begins at 10 PM GMT and ends at 7 AM GMT. This is the first major session to kick off the forex trading day. It is relatively quieter compared to other sessions because of lower trading volumes, but it can set the tone for the next sessions. Traders often watch the Australian dollar (AUD), New Zealand dollar (NZD), and other Asia-Pacific currencies during this session.

The Tokyo session overlaps with the Sydney session and starts at 12 AM GMT. It ends at 9 AM GMT. The Tokyo session sees increased activity as Japanese banks and financial institutions participate in trading. This session is significant for trading pairs involving the Japanese yen (JPY), as well as other Asian currencies. Traders often take advantage of volatility during this period, particularly before the London session opens.

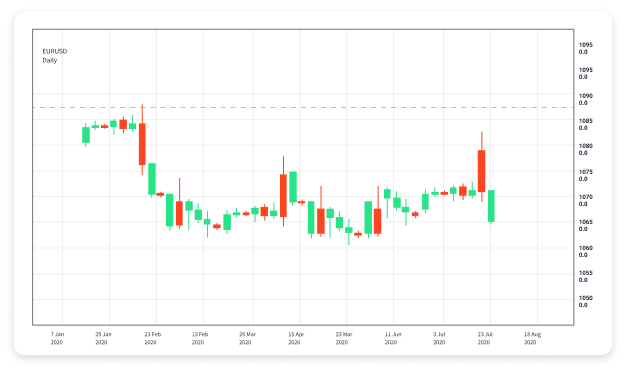

The London session is one of the most important trading sessions, beginning at 8 AM GMT and ending at 5 PM GMT. This session sees the highest volume of trading, making it an excellent opportunity for traders. The London session plays a crucial role due to the concentration of wealth and trading power in Europe. Currency pairs such as EUR/USD, GBP/USD, and other cross currencies are actively traded during this time.

The New York session opens at 1 PM GMT and closes at 10 PM GMT. As the financial hub of the United States, this session is very influential, especially for traders focusing on the US dollar (USD). The overlap between the London and New York sessions (1 PM to 5 PM GMT) offers the best trading opportunities due to the high liquidity and volatility.

To maximize your trading outcomes, it is essential to trade during times when the market is most active. The best times to trade often occur during the overlap between different sessions:

Volatility is a crucial factor in forex trading. Volatile market conditions can lead to larger price swings and, consequently, more opportunities for profit-making. Understanding when high volatility occurs can guide traders in choosing the best trading times. The London session is typically known for higher volatility, widely recognized as an ideal time for trading major currency pairs.

Several factors influence forex trading times, including economic reports, geopolitical events, and central bank announcements. Traders should keep an eye on economic calendars to prepare for potential volatility during upcoming news releases. High-impact news events often lead to increased market activity, affecting currency pair movement significantly.

Here are some tips to help you make the most of your forex trading times:

Understanding forex trading times is essential for enhancing your trading strategy. By being aware of the different sessions, the overlaps between them, and the factors influencing volatility, you can increase your chances of making profitable trades. Whether you’re a seasoned trader or just starting, learning to leverage trading times will ultimately lead to a more informed and effective trading approach.

In conclusion, be strategic in your trading approach and always pay attention to market conditions. This will ensure that you are trading at the right times to maximize profit potential and minimize losses in the fast-paced world of forex trading.

by admin on Wed 29th October 2025